Learn how to choose an insurance that complies with Amazon's new insurance policy requirements, while addressing your own specific needs.

Table Of Contents

Following Amazon’s announcement requiring sellers, who have made at least $10k in sales for any given month, to carry product liability insurance, many Amazon merchants were left baffled by the fact that they would need to purchase liability insurance for the first time. Purchasing liability insurance for a business is not an easy task, yet in this case, things become even more complicated because Amazon requires the seller’s policy to name “Amazon.com Services LLC., and its affiliates and assignees” as additional insured. As an insured party in the policy, Amazon has listed numerous insurance policy requirements. So, to help you understand what you should ask for when purchasing Amazon liability insurance, we have put together a guide that will help you purchase the right policy that meets your needs and complies with Amazon’s insurance requirements.

A deep dive into Amazon's new insurance requirements

As mentioned above, as an insured party in your insurance policy, Amazon has quite a few requirements for your insurance. The requirements are listed on Amazon’s Insurance Requirements page, let’s explain what each one means:

Policy limit must be at least $1 million

the policy limits must be at least $1 million per occurrence and in aggregate, covering all liabilities caused by or occurring in conjunction with the operation of your business, including products, products/completed operations, and bodily injury. So basically, this means if your sales are over $10,000 in one month, you will need to carry insurance with at least $1,000,000 in coverage. Some merchants may think it’s excessive and that their products are not dangerous, but if you sell a product to your consumer, and it causes property damage or injures the buyer, you will need insurance to protect yourself from liability. Even if you are not selling a dangerous item, it doesn’t mean that you don’t have liability. All it takes is a single defective item to put your business at risk. And although there are policies that offer lower limits, you need to select the one that complies with this requirement.

* Check Spott’s general liability insurance for Amazon sellers

UPDATE:

It seems that Amazon’s internal calculations have become non-transparent and invariable. Despite the $10K mark, they may demand that you acquire liability insurance even if you are making less.

Yes, Amazon can be unpredictable. But that’s why we are here, with our finger on the pulse, to make sure you are aware of these changes and have the tools to comply.

Policy types

The policy type can be either commercial general, umbrella, or excess liability insurance and must be written on an occurrence basis. You may also satisfy the insurance limits by using any combination of Commercial General Liability and Umbrella and/or Excess Liability insurance (if you do this, the required ‘Additional Insured’ wording):

- General liability insurance covers common business risks like customer injury, customer property damage, and advertising injury. It protects your small business from the high costs of lawsuits and helps you qualify for leases and contracts. This is the most common policy type, covering most common needs of Amazon sellers.

- Excess liability insurance provides additional coverage for one of your liability insurance policies, typically general liability insurance. It activates when that policy reaches its limit.

- Commercial umbrella insurance provides additional coverage for several of your liability insurance policies. It kicks in when one of the underlying policies reaches its limit.

Type of insurance provider

- Amazon specifies that the insurance provider must have global claim handling capability, which means they are able to handle claims from around the world. To ensure the financial stability and quality of the insurance provider, they also require that the insurance provider must have a financial rating of S&P A- and/or AM Best A– or better or a local equivalent.

Cancellation notice

the insurance provider must give Amazon at least 30 days’ notice of cancellation, modification, or nonrenewal. As discussed below, since Amazon is a party in this policy, although the seller is paying the premiums, Amazon requires that the service provider notifies them if it is canceled.

Deductibles

A deductible is an amount the policyholder pays toward an insured loss. Deductibles are how risk is shared between you and your insurer. Generally speaking, the larger the deductible, the less you pay in premiums for an insurance policy. Until recently, Amazon required third-party sellers to acquire commercial liability insurance policies with deductibles up to $10,000. However, as of last June, sellers whose gross sales are up to $1M or less may not have any deductibles.

This revision is a sharp turn from Amazon. Deductibles are very common in liability policies. They are a way for sellers to significantly decrease the cost of their policy since the more you pay in deductible, the lower the premium. As a non-deductible insurance plan comes with a higher premium, this will likely mean that third-party sellers will have to acquire insurance policies at much greater costs.

Legal entity

Until now, Amazon required that only the names of your legal entity be allowed on your insurance policy. However, another change that Amazon made in June, which benefits all sellers on the platform, enables users to create their policy on a Doing Business As (DBA) name instead of a legal entity, should that be preferred.

Include all products

The policy must cover all sales from products you have listed on the Amazon website. As discussed below, each product may have different attributes and risks and for this reason in addition to this requirement, it is also important to discuss with your carrier when you add products or change production methods, materials, or designs on current products.

Are you a "manufacturer" or a "retailer" for insurance purposes?

Insurance policies vary between those who are considered “manufacturers” and those who are merely retailers of a product, which is manufactured by someone else. But in the world of Amazon Sellers, the lines can become a bit blurry. Here are some “rules of thumb” questions to consider:

- I resell known brands – this is the easiest case because in this case you will not be considered a manufacturer. This means that in case of litigation, some (if not all) of the liability may be transferred to the manufacturer, which is also the brand owner. However, the question still remains what is considered a “known brand”? As a rule of thumb, for the purpose of insurance liability, a “known brand” would be a brand that can be sued in a legal proceeding. Although brands from China can be sued, it could be much more challenging to do so. So, if it’s a brand that includes an entity in a western country, chances are that they can be found liable for the damage, and therefore you can purchase liability insurance as a “retailer”.

I have a private label – this is the most common model amongst Amazon sellers. According to this model, the products are manufactured by the manufacturer and sold with (and under) the Amazon seller’s own brand. In this case, although the Amazon seller did not manufacture the product, as a brand owner, the Amazon seller may be found responsible for the product’s quality. And since it would be difficult to sue the manufacturer, for example, if the manufacturer is from China, the liability may fall exclusively on the seller. Therefore, in this case, it is recommended to purchase liability insurance as a “manufacturer” of the product. Many Amazon sellers are unaware of this distinction and have their policy written incorrectly.

Additional duties as a manufacturer

As a manufacturer, you have additional duties towards the carrier that relate to product liability exclusions. In other words, if as a manufacturer you do not comply with these requirements, the carrier can deny payment. For example:

- Quality control – manufacturers and distributors need to maintain quality control standards to ensure products are safe for consumers.

- Reporting of new products and methods – failure to report new manufacturing methods, products, materials, or ingredients can mean your policy doesn’t cover your product.

- Product recalls – most product liability policies don’t cover costs associated with the withdrawal, inspection, repair, replacement, or loss of use of an insured’s product if it’s recalled.

It’s not over until you actually submit the policy to Amazon

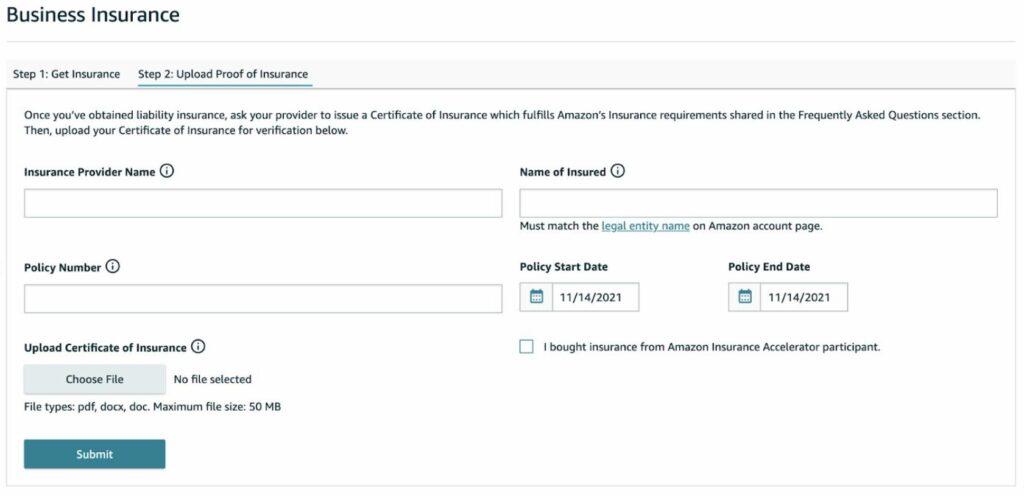

So you have purchased your policy and you are finally relaxed because you are covered, right? Well, from Amazon’s perspective this process is not over until you submit the Certificate of Insurance for review in the Upload Proof of Insurance screen (see below) and you have received a confirmation from Amazon.

Summary

As we’ve seen, e-commerce insurance has a lot of intricacies that translate into unnecessary risks and high premium costs. For this reason, it is important to purchase the insurance from a trusted provider that specializes in the field insurance for e-commerce and not just general insurance. Spott provides this type of domain expertise and as part of the process, Spott ensures that the policy that you purchase will comply with Amazon’s requirements.