Since Amazon made it mandatory for all third-party sellers to get their business insured, most eCommerce merchants are acquiring their policies online. Getting your Amazon Liability Insurance online is easiest, safest, and fastest, and it’s the only way to guarantee the best price.

Here’s a step-by-step guide to getting your COIs in no time. No prior experience is needed or extra research. That’s what we’re here for.

Follow these 10 easy steps to get your business insured. It’s easy, fast and involves zero hassle:

Step #1: Go to spottme.com and press Get started

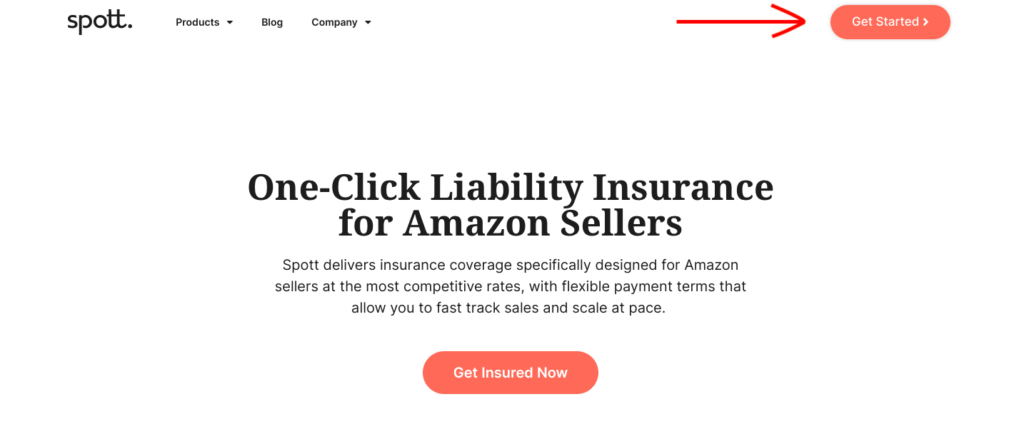

Step #2: Click on “Get started”

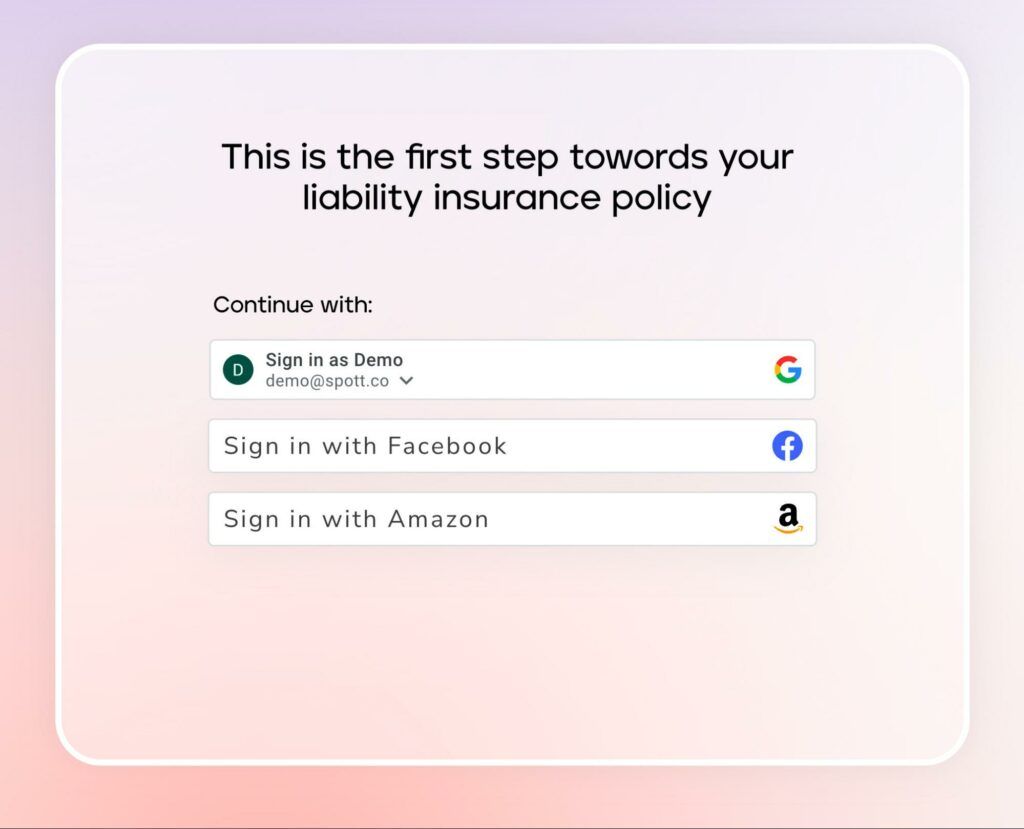

Step #3: Onboarding. Sign in with your method of preference:

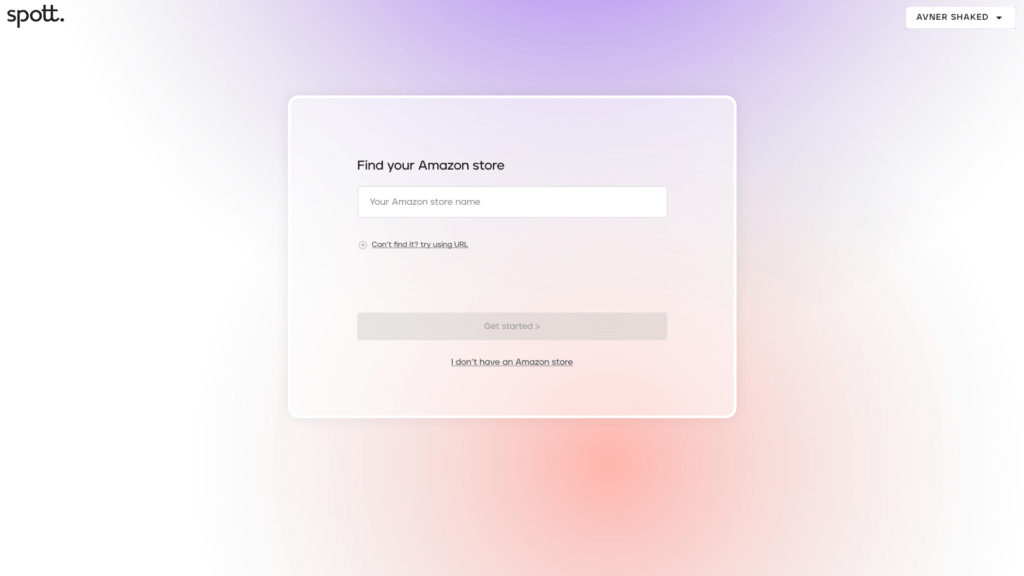

Step #4: Fill in the name of your Amazon store

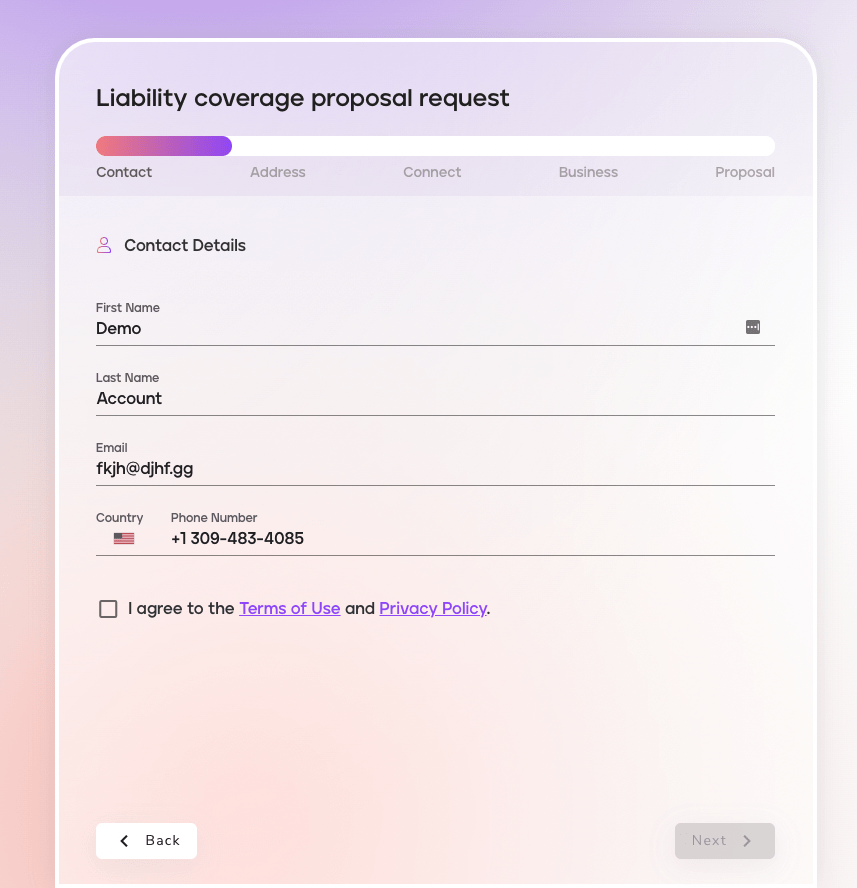

Step #5: Enter some basic contact info

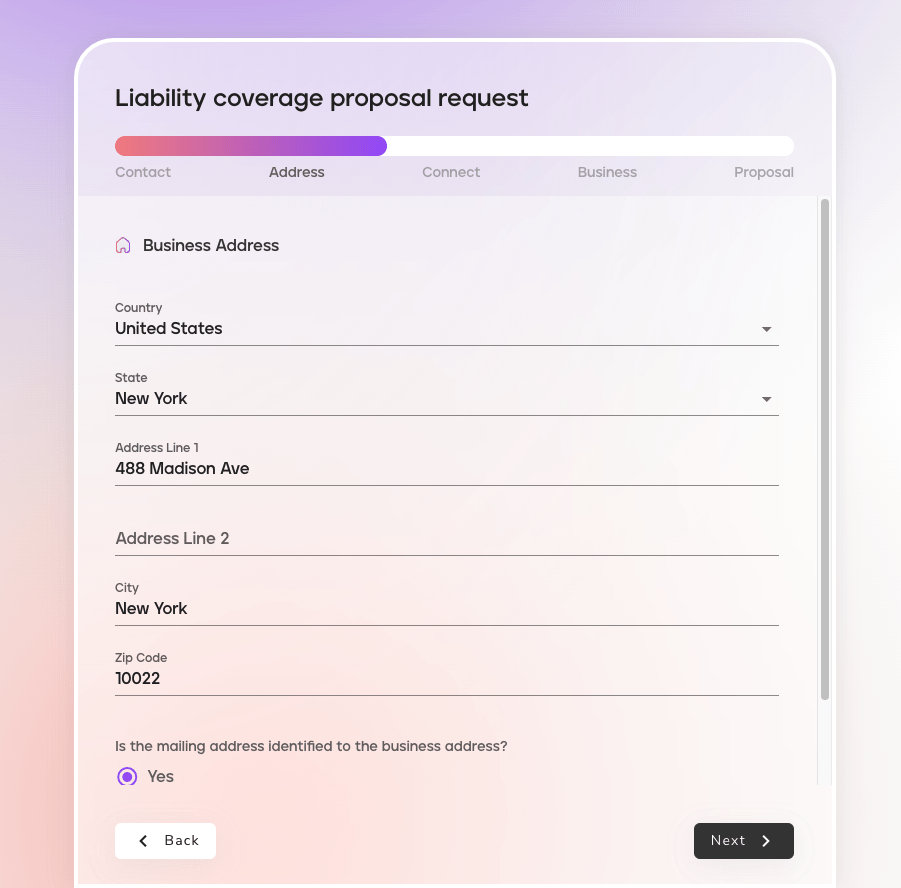

Step #6: Enter your business address

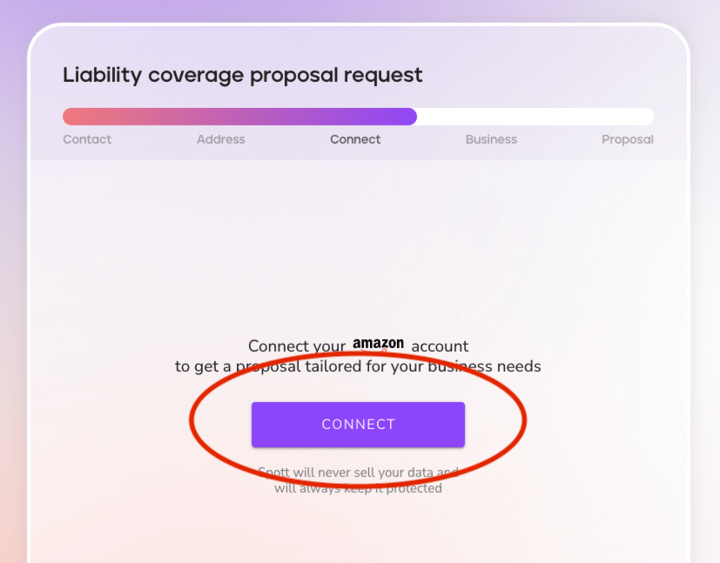

Step #7: Connect!

Once you click on “connect”, Spott can analyze your store information, including the products you sell and the volume of your sales. This enables us to qualify the risk factor of your store and find the best policy quote for you.

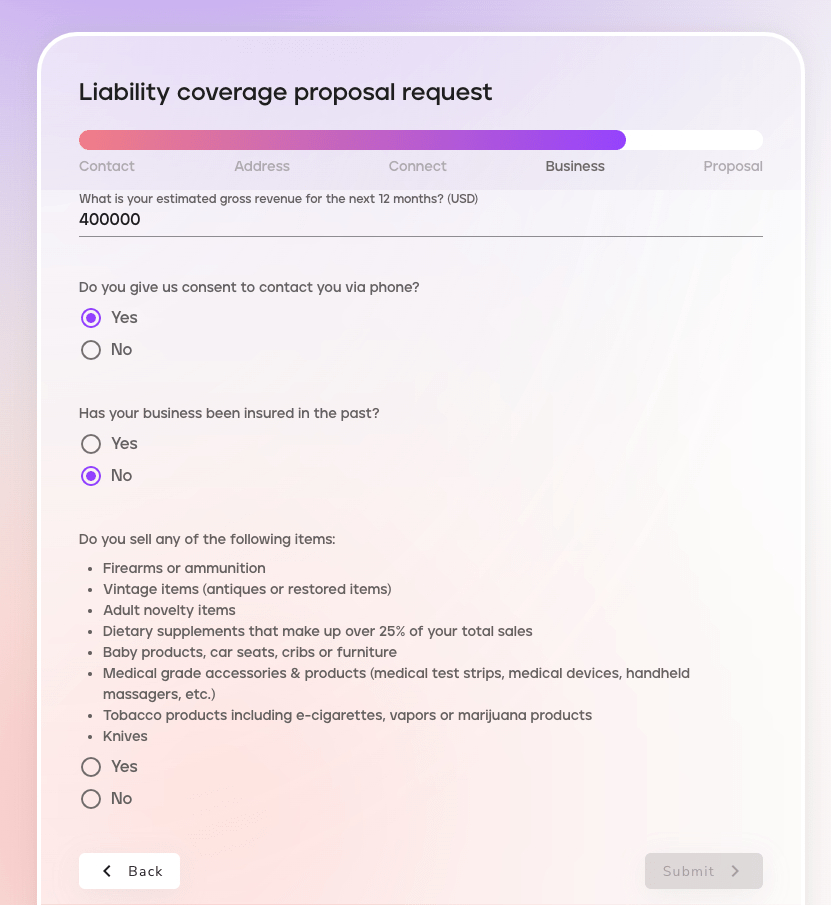

Step #8: Add a few details about your products

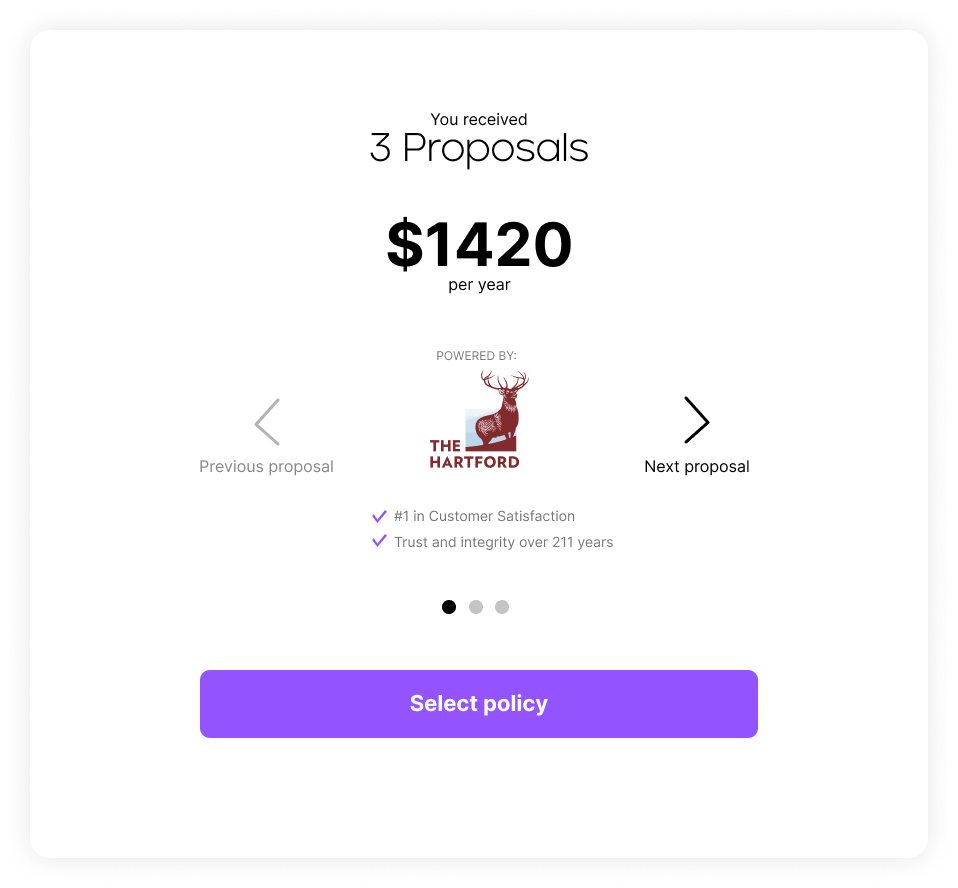

Step #9: Get your quote!

Done deal! You get your COI then upload it to your Amazon account. Click here for an easy guide on how to upload your COI.

You are set! Now you can sleep at night, knowing that you’re covered.

Want to read a little more about why you need insurance? Click here.

Additional information about Amazon insurance policy:

The policy must cover all liabilities related to your online business:

- Products liability

- Bodily injury

- Personal injury

- Property damage

3 Types of Policy

Amazon demands one or more of these policies:

- Commercial general liability (CGL)

The usual go-to policy for most online sellers. It typically covers you as well as any claims that involve bodily injuries and property damage as a result of your products, services or operations.

- Umbrella

This insurance boosts the coverage on your general liability policy once the limit is reached on a claim, including claims like false arrest, libel, slander, and liability coverage on rental units you own.

- Excess liability

Excess liability is the amount you have to pay towards the overall cost of an insurance claim. It’s usually a pre-agreed amount. Your insurer will then contribute the rest – up to the limit of the cover.

Excess and Umbrella insurance policies are pretty similar! Confused? Here are the differences:

Excess insurance policies do not affect the terms of your underlying policy – but it provides additional limits. Umbrella insurance is a wider kind of excess insurance that covers additional situations outside the scope of the underlying policy

Whichever policy you go for must be based on occurrence.

Policy Deductible and Coverage

The deductible for products in the marketplace must be under $10,000. Amazon will not accept any higher than that. It’s an important item and must be listed on your certificates of insurance.

Insurance Provider rates

The financial rating must be S&P A-, AM Best A-, or higher. Your provider must have Global claim handling capabilities.

Amazon as an added insured

Choose the policy that adds insured free of charge so you can add Amazon as an additional insured.

Make sure the name of your insurer matches the name on your COI. Every letter counts! Make sure the spelling is correct.

Cancellation of policy

Any notification of modifying or canceling your policy must be communicated to Amazon within 30 days’ notice.

When am I good to go?

The policy must be signed and completed within at least 60 days from the submission date to Amazon.

Certificate of Insurance AKA COI

You’ll get this document from your insurance provider. The COI includes the persons and property covered, the coverage amount, deductions and exclusions.

Amazon gives you 30 days to upload the certificate of insurance to Seller Central.

Having your store insured protects you from all risks. Even though the chances of getting sued are low, it is not zero. And should you be sued, being insured will be the difference between “being protected” and suffering the “total loss” of your business.

All this goodness – in a few clicks. Don’t risk your business! Get started today.